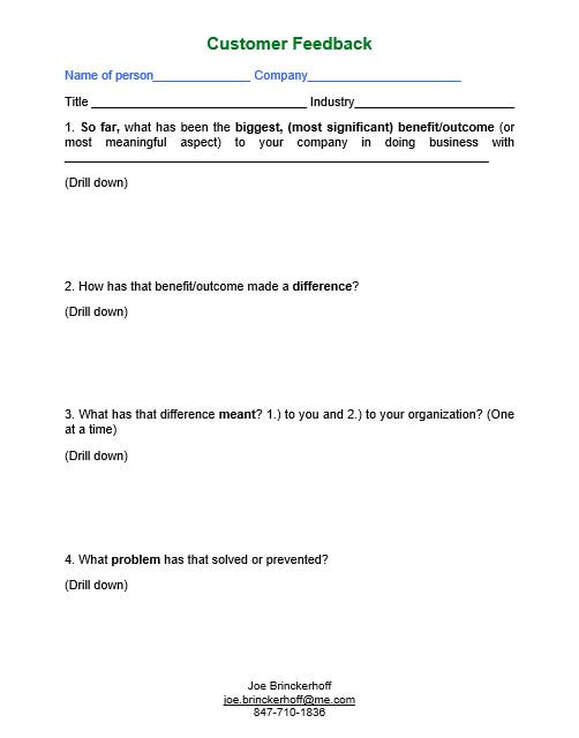

1. The goal is to ask for feedback by way of responses to the questions below and write down as much word for word what is said, rather than summarizing.

2. Do this with people in various levels of responsibility.

3. This feedback is vital in crafting language that allows us to initially impact what other customers and potential prospects hear. Each of these questions is meant to be a starter question. We want to dig into initial responses as they describe the impact in their business. Each question is designed to focus on their results, not just what they say about us. You may want to write responses on the back of this sheet.

4. DO NOT SEND THIS TO CLIENTS AND ASK THEM TO COMPLETE IT! It will take away any follow up questions.

5. As you accumulate responses, you will see patterns to incorporate into your approach to others. It will broaden your results, allow you to speak much more from client and prospects viewpoint, and impact the number of people with whom meaningful business conversations are possible.

• Make 5 blank copies to start, and then continue doing with each person you have contact.

• Put the customer’s name and position title on each sheet.

• In contacting, ask customers if they would be open to giving some

“feedback” about their business relationship with our firm.

RSS Feed

RSS Feed