|

Networking Calendar:

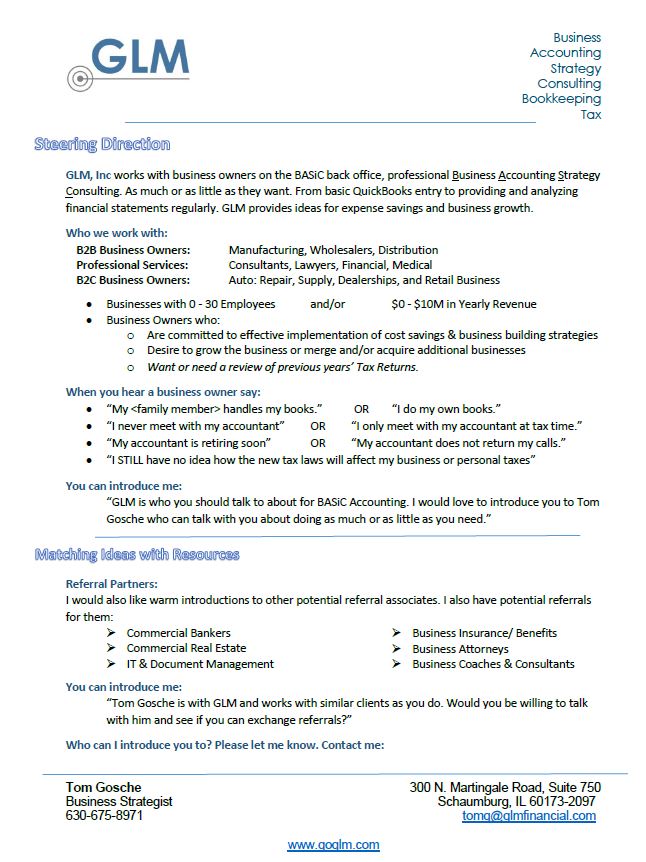

https://www.glm-accounting-bookkeeping.com/networking-calendar.html Learn More from Tom Gosche, Business Strategist from GLM [email protected] 630-675-8971 Matching Ideas with Resources I'd like to introduce you to David Telisman, an experienced writer and content creator, who works with businesses to inspire their customers to buy from them. David believes that his clients deserve to feel proud of how their content marketing looks and what it says, and he delivers by providing expert copywriting and digital marketing solutions. You can visit his website where you can find testimonials and his portfolio of work. Please let me know if you're open to having a conversation with him. Thank you. What (Specifically) do you do? David Telisman is a content writer and creator. How do you do it? Website copywriting, design, and hosting. Blogs, articles, email marketing, and social media marketing What is a “Typical Situation” people are in when they realize they need your help? They need a new website because theirs is old and static. They need to tell their story better and make sure it gets to the right people. What is something someone might say that would lead me to think of you?

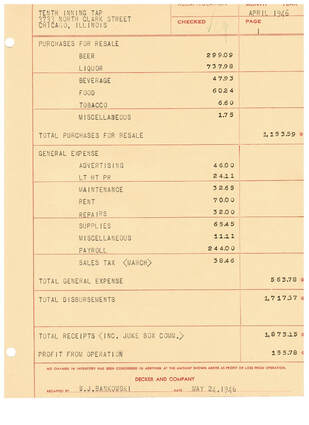

My dad came across the Financial Statements of his dad's business from April 1946. I scanned a page of it to the right. The way QuickBooks currently prints a Profit and Loss Statement, you have the Revenue at the top and then Costs of Goods, then Expenses and finally the Profit at the bottom, but this statement has all the Expenses, then the Revenue THEN the Profit. The numbers are interesting. As you could guess, it is a bar, a few blocks away from Wrigley Field. In 1946 the average family income was about $2,600 per year or $216.66 per month. The profit for this month was $155.78. Previous month's profits averaged $670. Why was this month so low? As I looked at the details of the financials, I saw that he bought additional beer this month. Maybe there was a deal, or added a new brand. Having monthly financial statements are important for a business. They answer questions you might have. Can you take advantage of a suppliers' deal? Will purchasing equipment be a better advantage this month or next? What is your business worth? I did a quick Valuation of my Grandfather's business, based on the financials we found. At the beginning of 1946, it would be worth about $28,140. In June 1946, it would be worth over $40,000. What do you think a major factor was in the increase in the business value in those first 6 months of 1946? (Hint: When was the last time the Cubs were in the World Series?) You save money on expense by streamlining your processes. As we begin the Eighth month of 2020, let’s take a look at your business process.

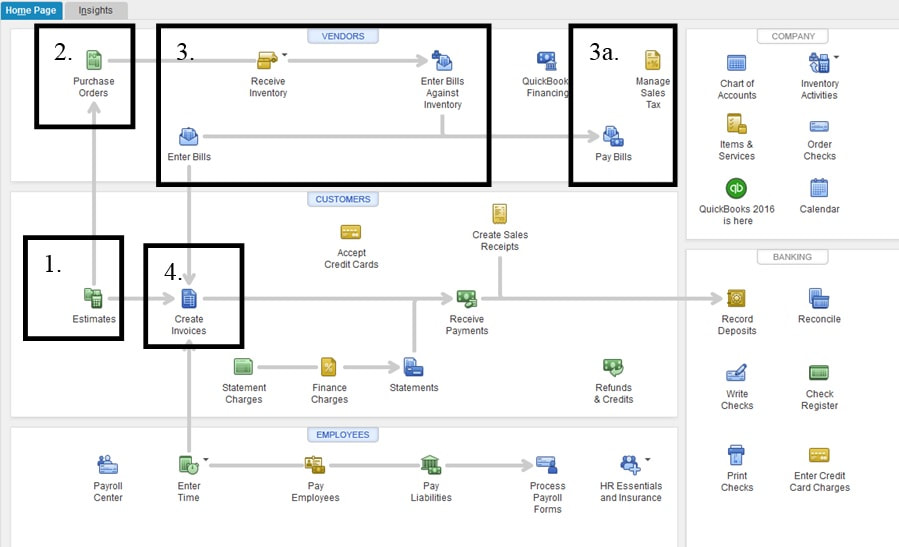

Let’s look at an example: Quote: A quotation is generated in Microsoft Word and sent to the customer for the work to be done. Quote includes estimate on materials, shipping and scheduling. Purchase Order: Once the customer agrees and signed the quote, a Purchase order is generated in Microsoft Works to the vender. This starts the Job Expense Sheet in Microsoft Excel. It includes specifics on materials, shipping and scheduling. Vender Bill: Now the job is done, and the vendor bills you. Your company then has to run it through a Tax Worksheet (in Excel) to calculate sales tax, and Services. After doing the Tax Worksheet, they enter the amounts on the Job Expense Sheet. Freight Costs: Make sure the freight costs are entered onto the Job Expense Sheet. Invoice to Client: The invoice is prepared in QuickBooks from the Job Cost worksheet and Emailed to the client. This maybe the process you have been using for years. Maybe it started simple enough, but then new steps needed to be added along the way. Let’s say this process takes about an hour per sale. Streamline the process to use one program instead of 4. Sure, the initial set up may take some time, but the change in the long run saves you both time and money. If you notice, the sample company does use QuickBooks to do their invoicing. We can also assume they track their expenses in QuickBooks in order to be able to come up with financial statements. After some training by a certified QuickBooks advisor, the company could use QuickBooks for:

The company would enter the info into QuickBooks and the bookkeeper would check it and follow up on invoices. After a 3 hour (or so) QuickBooks Training and Set up, the whole process may only take about 15 minutes per sale, as opposed to the hour it previously took. Thus saving both time and money! Improve your process and improve your business! |

GLM's BlogIn true blog fashion, the last parts are at the top of the page. Scroll all the way down and work your way back up to read them in order.

Tom GoscheTom is the Business Development Manager for GLM. If you are interested in learning more about GLM's services, contact him: 630-675-8971

[email protected] Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed