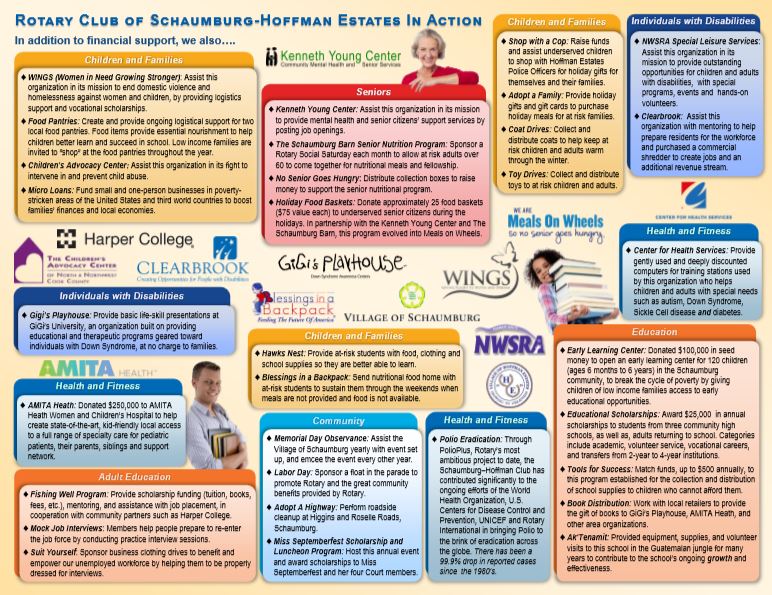

The group of 70 business and community leaders are devoted to the ongoing efforts of Rotary International’s 1.2 million neighbors, friends, and community leaders who come together to create positive, lasting change in local and global communities. Together they have raised millions of dollars used to enrich the lives of youth, families and seniors, through our own efforts and by providing assistance to other charitable organizations.

The member's differing occupations, cultures, and countries give us a unique perspective. Our shared passion for service helps us accomplish the remarkable.

What makes Rotary Club of Schaumburg / Hoffman Estates DIFFERENT? The unique point of view and approach gives distinct advantages:

- They see differently: The multidisciplinary perspective helps see challenges in unique ways.

- They think differently. Applying leadership and expertise to social issues—and find unique solutions.

- They act responsibly: Members are all volunteers with a passion and perseverance to create lasting change so every dime raised goes toward projects.

The members can be found in your community, as well as, around the globe.

RSS Feed

RSS Feed