Maybe there has been an employee Injury or death, news of worker (s) being injured on the job or equipment failure.

When you hear a business owner say:

- “I need to reduce Worker Compensation Claims.”

- “I hate dealing with worker turnover.”

- “General: working Worker Safety/Prevention; Worker Safety Training “

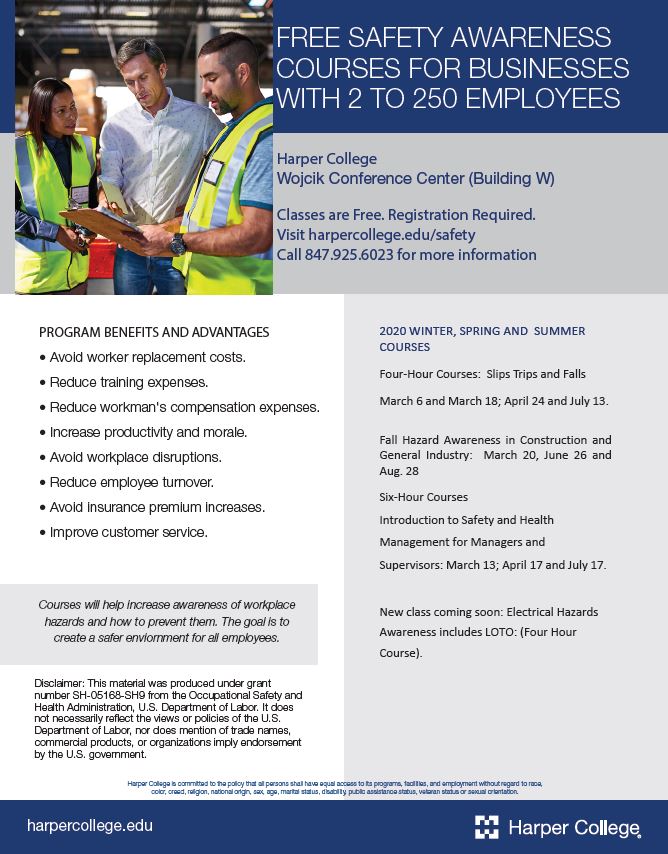

They Provide FREE Safety Awareness to businesses with 2-250 employees within the U.S.

Four and six hour, FREE courses on numerous safety topics.

How they Work: Harper provides free safety awareness courses from the Susan Harwood Training Grant. We provide high quality courses that instructed by OSHA Outreach Trainers. The courses are relevant as the training topics have been selected by needs of community that were surveyed. Courses offered until late Summer 2020.

You can introduce them:

“Harper College has FREE safety awareness courses taught by Safety Professionals and OSHA Outreach trainers. These courses can reduce your business operating expenses, increase employee morale and turnover. The website is: www.harpercollege.edu/safety.”

Matching Ideas with Resources:

RSS Feed

RSS Feed