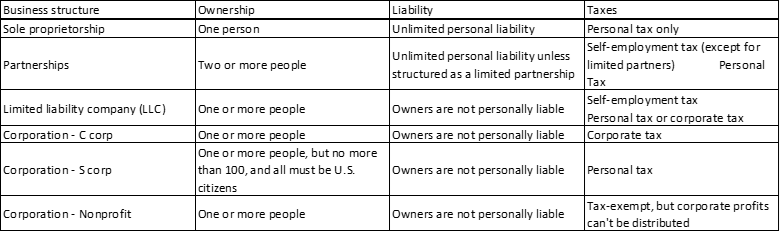

Your business structure affects how much you pay in taxes, your ability to raise money, the paperwork you need to file, and your personal liability. This week we talk about Partnerships.

Partnership

Partnerships are the simplest structure for two or more people to own a business together. There are two common kinds of partnerships: limited partnerships (LP) and limited liability partnerships (LLP).

Limited partnerships have only one general partner with unlimited liability, and all other partners have limited liability. The partners with limited liability also tend to have limited control over the company, which is documented in a partnership agreement. Profits are passed through to personal tax returns, and the general partner — the partner without limited liability — must also pay self-employment taxes.

Limited liability partnerships are similar to limited partnerships, but give limited liability to every owner. An LLP protects each partner from debts against the partnership, they won't be responsible for the actions of other partners.

Partnerships can be a good choice for businesses with multiple owners, professional groups (like attorneys), and groups who want to test their business idea before forming a more formal business.

Limited liability company (LLC)

An LLC lets you take advantage of the benefits of both the corporation and partnership business structures.

LLCs protect you from personal liability in most instances, your personal assets — like your vehicle, house, and savings accounts — won't be at risk in case your LLC faces bankruptcy or lawsuits.

Profits and losses can get passed through to your personal income without facing corporate taxes. However, members of an LLC are considered self-employed and must pay self-employment tax contributions towards Medicare and Social Security.

LLCs can be a good choice for medium- or higher-risk businesses, owners with significant personal assets they want to be protected, and owners who want to pay a lower tax rate than they would with a corporation.

RSS Feed

RSS Feed