|

Business networking can be one of the most rewarding aspects of professional life, opening doors to new opportunities, partnerships, and friendships. However, it also comes with its challenges, one of the most common being dealing with difficult people. Whether it's the overly aggressive salesperson, the relentless self-promoter, or the person who always seems to know everything, navigating these interactions gracefully is crucial. Here are some strategies to help you handle difficult people effectively while business networking.

1. Stay Calm and Professional The cornerstone of dealing with any difficult person is maintaining your composure. It's easy to get flustered or frustrated, but responding with calmness and professionalism can diffuse tension and set a positive tone. Take deep breaths, maintain a steady tone of voice, and keep your body language open and relaxed. 2. Set Boundaries Setting boundaries is essential when interacting with pushy or intrusive individuals. Politely but firmly indicate your limits. For instance, if someone monopolizes your time, you can say, "It was great speaking with you, but I need to connect with a few other people here." This approach respects both your needs and theirs without causing offense. 3. Listen Actively Sometimes, difficult people just want to be heard. By listening actively, you can often find common ground or at least understand their perspective better. This doesn't mean you have to agree with them, but showing empathy can turn a potentially negative interaction into a more positive one. 4. Steer the Conversation If the conversation is heading in an uncomfortable or unproductive direction, gently steer it towards more neutral or beneficial topics. Ask open-ended questions that can shift the focus away from contentious subjects. For example, if someone is complaining excessively, you might ask, "What projects are you excited about this year?" 5. Use Humor Wisely A well-timed joke or light-hearted comment can ease tension and disarm a difficult person. However, be cautious with humor, as it can backfire if not used appropriately. Ensure your humor is inoffensive and relevant to the situation. 6. Avoid Getting Defensive It's natural to want to defend yourself if you feel attacked or criticized, but getting defensive can escalate the situation. Instead, acknowledge the other person's viewpoint and respond with a balanced perspective. For instance, "I see why you might think that. In my experience, though, I've found that..." 7. Know When to Disengage Sometimes, the best course of action is to gracefully exit the conversation. If someone is being particularly difficult and unresponsive to your attempts at a positive interaction, it's perfectly acceptable to excuse yourself. You can say, "I need to check in with someone" or "I have to step away for a moment." Your time is valuable, and it's important to spend it where it counts. 8. Follow Up Thoughtfully If you anticipate future interactions with a difficult person, a thoughtful follow-up can help improve the relationship. Send a brief, polite email summarizing any constructive points from your conversation, and suggest a future meeting to discuss positive collaborations. This shows professionalism and a willingness to move forward constructively. 9. Reflect and Learn After the networking event, take some time to reflect on your interactions. Consider what strategies worked well and what you could improve for next time. Learning from each experience will make you more adept at handling difficult people in the future. Conclusion Dealing with difficult people is an inevitable part of business networking, but it doesn't have to derail your efforts. By staying calm, setting boundaries, listening actively, and using these strategies, you can navigate challenging interactions with grace and professionalism. Remember, every difficult interaction is an opportunity to hone your skills and become a more effective networker. Happy networking! The past few years have seen a surge in new business startups across industries. From tech companies developing cutting-edge software to mom-and-pop shops opening local storefronts, entrepreneurs are taking the plunge and launching their own ventures at unprecedented rates. But what's driving this startup boom? Let's explore some of the key factors behind this entrepreneurial renaissance.

1. The Gig Economy and Remote Work Revolution The COVID-19 pandemic accelerated the shift towards remote work and the gig economy. As more people experienced the flexibility of working from home, many became disillusioned with traditional 9-to-5 jobs. This newfound freedom, coupled with layoffs and economic uncertainty, inspired waves of people to pursue their entrepreneurial dreams and start their own businesses. 2. Rapid Technological Advancements Technological innovations have lowered the barriers to entry for aspiring entrepreneurs. Cloud computing, e-commerce platforms, and powerful marketing tools have made it easier and more affordable than ever to launch and scale a business. From creating a website to managing inventory, technology has streamlined many of the processes that previously hindered startup growth. 3. Access to Funding and Investment Opportunities The startup ecosystem has flourished thanks to increased access to funding sources. Crowdfunding platforms like Kickstarter and IndieGoGo have allowed entrepreneurs to pitch their ideas directly to potential backers. Meanwhile, angel investors and venture capitalists have continued to pour money into promising startups across various sectors. 4. The Appeal of Pursuing Passion Projects For many entrepreneurs, starting a business is about more than just making money – it's about turning their passions into profitable ventures. With greater work-life flexibility and a desire for fulfillment, a growing number of people are transforming their hobbies, interests, and skillsets into thriving businesses. 5. A Culture of Innovation and Risk-Taking Entrepreneurship has become increasingly celebrated and glamorized in popular culture. Success stories of startup founders turned billionaires have inspired a new generation of risk-takers who aren't afraid to disrupt industries and challenge the status quo. This cultural shift has created an environment that encourages innovation and celebrates the entrepreneurial spirit. As the world continues to evolve, it's likely that the startup boom will persist. With the right combination of passion, determination, and access to resources, aspiring entrepreneurs can turn their dreams into reality and contribute to the ever-growing Startup Nation. As the vibrant colors of spring emerge and the world awakens from the slumber of winter, it's the perfect time for businesses to embrace growth and development. Just as nature undergoes a transformation, businesses too can seize the opportunities of the season to flourish and thrive. In this blog post, we'll explore five actionable strategies for businesses to spring into growth and achieve business development success.

Spring Cleaning" Your Sales Pipeline Just as you tidy up your home after winter, it's essential to declutter and refine your sales pipeline. Evaluate your leads and opportunities, identifying and prioritizing those with the highest potential for conversion. By streamlining your sales process and focusing your efforts on qualified leads, you can optimize your sales pipeline for maximum efficiency and effectiveness. Networking Events and Conferences Spring is a season of renewal and growth, making it an ideal time to expand your professional network. Attend industry events, conferences, and networking mixers to connect with potential clients, partners, and collaborators. Building and nurturing relationships in person can open doors to new opportunities and help propel your business forward. Leveraging Seasonal Trends Spring brings with it a shift in consumer behavior and preferences, presenting businesses with unique opportunities for growth. Whether it's capitalizing on the increased demand for outdoor activities, refreshing your product offerings with seasonal promotions, or tapping into emerging trends, aligning your strategies with seasonal shifts can give your business a competitive edge. Refreshing Your Marketing Strategies Just as flowers bloom in spring, your marketing strategies should also undergo a renewal. Evaluate your current marketing efforts and consider how you can refresh them for the season. Incorporate seasonal themes and imagery into your campaigns, leverage social media channels to engage with your audience, and experiment with new tactics to capture attention and drive engagement. Cultivating Strategic Partnerships Spring is a time of growth and collaboration, making it an opportune moment to cultivate strategic partnerships. Identify businesses or organizations that complement your own offerings and explore opportunities for collaboration. Whether it's co-hosting events, cross-promoting products or services, or sharing resources, strategic partnerships can expand your reach and open doors to new markets. In conclusion, spring is a season of growth, renewal, and opportunity. By implementing these five strategies for business development success, you can harness the energy of the season to propel your business forward. Embrace the spirit of spring, and watch your business bloom! Introduction:

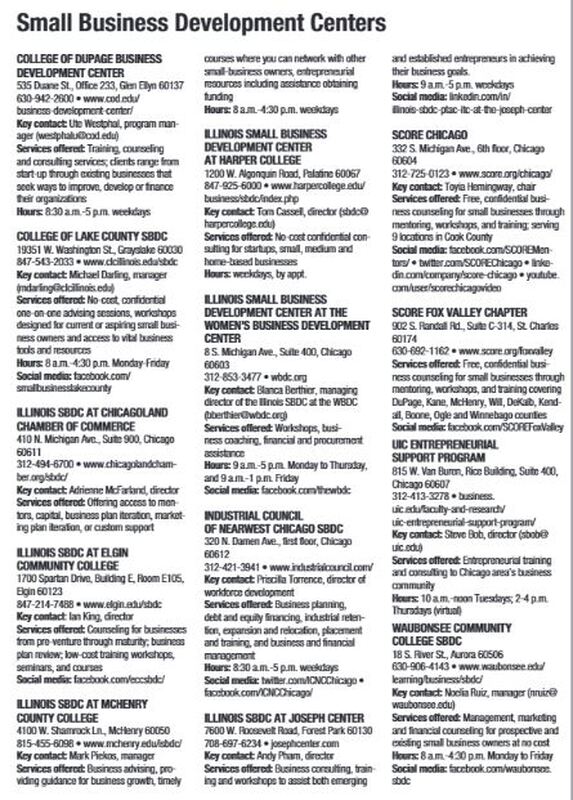

Small Business Week is a time to celebrate the spirit of entrepreneurship and the vital role that small businesses play in our communities. Beyond the individual hustle and grind, there's a powerful force that often goes unnoticed – collaboration among small businesses. In this blog post, we'll explore why collaboration is so essential for small businesses and how it can be a game-changer in driving success and sustainability. 1. Strength in Community: Small businesses are the heartbeat of local communities, and collaboration strengthens this interconnected ecosystem. By collaborating with neighboring businesses, small enterprises can create a supportive network that fosters growth, shares resources, and promotes collective prosperity. Whether it's organizing joint events, cross-promoting products or services, or simply offering mutual support, collaboration strengthens community bonds and enhances the overall business environment. 2. Amplified Visibility and Reach: Collaboration offers small businesses a platform to amplify their visibility and reach. By partnering with complementary businesses, they can tap into each other's customer bases and expand their reach beyond their immediate networks. For example, a boutique clothing store might collaborate with a local jewelry maker for a themed fashion event, attracting customers interested in both fashion and accessories. Through collaborative marketing efforts, businesses can leverage each other's strengths to attract new customers and increase brand awareness. 3. Shared Resources and Expertise: Small businesses often face resource constraints, whether it's financial limitations, limited manpower, or expertise gaps. Collaboration enables them to overcome these challenges by pooling resources and sharing expertise. For instance, small businesses can collaborate on joint purchasing to negotiate better deals with suppliers, share office space or equipment to reduce overhead costs, or even exchange skills through informal mentorship arrangements. By leveraging each other's strengths, small businesses can operate more efficiently and effectively compete with larger rivals. 4. Innovation and Creativity: Collaboration breeds innovation and creativity by bringing together diverse perspectives and skill sets. Small businesses can collaborate on projects, initiatives, or even product development, sparking new ideas and approaches that may not have emerged in isolation. For example, a group of small businesses in the food industry might collaborate to create a themed culinary event or develop a new product line through joint brainstorming sessions. Through collaboration, small businesses can tap into their collective creativity to stay ahead of the curve and meet evolving customer needs. Conclusion: As we celebrate Small Business Week, let's recognize the transformative power of collaboration among small businesses. By fostering community, amplifying visibility, sharing resources, and nurturing creativity, collaboration unlocks opportunities for growth, resilience, and sustainability. Whether it's forging partnerships with neighboring businesses, participating in industry alliances, or joining collaborative networks, small businesses can achieve more together than they ever could alone. Here's to the spirit of collaboration – may it continue to drive the success and vitality of small businesses everywhere. A Small Business Development Center (SBDC) at a community college serves as a vital resource for aspiring entrepreneurs and small business owners within the local community. Here's why it's important:

If you want to Learn More, come and Visit the Oakton Community College SBDC Director, Maurae Gilbert McCants on May 20th at 9am. contact Tom Gosche at [email protected] or 630-675-8971 for more information. In the digital age, small businesses are constantly seeking innovative ways to stand out in a crowded marketplace. While traditional marketing strategies remain valuable, the emergence of video as a versatile tool has revolutionized the way businesses engage with their audience. Beyond its role in marketing, video offers a plethora of opportunities for small businesses to thrive and grow. Let's delve into why video is crucial for small businesses beyond just marketing:

1. Enhanced Communication: Video facilitates clear and concise communication. Whether it's explaining a product or service, providing tutorials, or offering customer support, videos can convey complex information in an easily digestible format. This helps in building trust and credibility with customers, leading to stronger relationships and increased loyalty. 2. Educational Content: Small businesses can leverage video to educate their audience about industry trends, best practices, and insights. By sharing valuable knowledge, businesses position themselves as industry experts, fostering credibility and authority within their niche. Educational videos not only attract potential customers but also serve as a resource for existing ones, strengthening brand loyalty. 3. Product Demonstrations: For businesses offering tangible products, video provides an effective platform for demonstrating their features and benefits. Unlike static images or text descriptions, videos allow customers to see the product in action, providing a more immersive and engaging experience. This can significantly influence purchase decisions and reduce hesitation, leading to increased sales. 4. Employee Training and Development: Training new employees can be a time-consuming and resource-intensive process for small businesses. Video training modules offer a scalable solution, enabling businesses to streamline the onboarding process and ensure consistency in training delivery. Additionally, video can be used for ongoing employee development, providing access to tutorials, skill-building exercises, and motivational content. 5. Internal Communication: Effective communication is essential for the smooth functioning of any business. Video can facilitate internal communication by allowing team members to share updates, brainstorm ideas, and collaborate on projects regardless of their geographical location. This fosters a sense of unity and cohesion among remote or distributed teams, enhancing productivity and efficiency. 6. Customer Testimonials and Case Studies: Nothing speaks louder than satisfied customers. Video testimonials and case studies provide social proof of a business's value proposition and customer satisfaction. By showcasing real-life experiences and success stories, businesses can instill confidence in potential customers and differentiate themselves from competitors. 7. Brand Storytelling: Every business has a unique story to tell. Video offers a compelling medium for businesses to share their journey, values, and vision with their audience. Through storytelling, businesses can forge emotional connections with viewers, humanize their brand, and leave a lasting impression. This emotional resonance can translate into increased brand loyalty and advocacy. 8. Community Building: Building a community around your brand is essential for long-term success. Video can be used to engage with your audience on a deeper level, whether through live Q&A sessions, behind-the-scenes glimpses, or interactive events. By fostering a sense of belonging and inclusivity, businesses can cultivate a loyal community of brand advocates who actively support and promote their products or services. In conclusion, video is a powerful tool that extends far beyond marketing for small businesses. From communication and education to brand storytelling and community building, video offers endless possibilities for businesses to connect with their audience, streamline operations, and drive growth. By embracing video as an integral part of their strategy, small businesses can unlock new opportunities and propel themselves towards success in the digital age. Should Business Owners Itemize or Take the Standard Deduction on Their Tax Returns?

Introduction: Tax season can be daunting for business owners, with various decisions to make regarding deductions and credits. One crucial decision is whether to itemize deductions or take the standard deduction. This choice can significantly impact your tax liability and financial well-being. In this blog post, we'll explore the factors business owners should consider when deciding between itemizing and taking the standard deduction. Understanding Itemized Deductions and the Standard Deduction: Before delving into the decision-making process, let's clarify the difference between itemized deductions and the standard deduction: 1. Itemized Deductions: These are individual expenses that you can claim on your tax return to reduce your taxable income. Common itemized deductions for business owners may include mortgage interest, property taxes, medical expenses, charitable contributions, and certain business expenses. 2. Standard Deduction: This is a fixed dollar amount that reduces the amount of income on which you're taxed. The standard deduction is available to all taxpayers, regardless of their expenses. The amount varies depending on your filing status. Factors to Consider for Business Owners: 1. Total Deductible Expenses: - Evaluate your deductible expenses for the tax year. Calculate the sum of your potential itemized deductions, including both personal and business-related expenses. Consider expenses such as mortgage interest, property taxes, state and local taxes, medical expenses, charitable donations, and allowable business expenses. 2. Documentation and Record-Keeping: - Itemizing deductions requires meticulous record-keeping and documentation of expenses. Ensure that you have accurate records to substantiate each deductible expense. Maintaining organized records throughout the year can streamline the tax-filing process and minimize the risk of audits. 3. Time and Complexity: - Itemizing deductions typically involves more time and effort compared to taking the standard deduction. You'll need to gather supporting documents, compute each deduction category, and complete additional forms. Consider whether the potential tax savings outweigh the additional time and complexity involved in itemizing. 4. Tax Savings: - Compare the tax savings generated by itemizing deductions versus taking the standard deduction. Use tax preparation software or consult with a tax professional to estimate your tax liability under both scenarios. Opt for the option that minimizes your tax burden while adhering to IRS regulations. 5. Changes in Tax Laws: - Stay informed about changes in tax laws that may affect deductible expenses and the standard deduction amount. Tax laws are subject to revision, and certain deductions or credits may be phased out or modified over time. Consider consulting with a tax advisor to navigate recent legislative changes and optimize your tax strategy. Conclusion: Deciding whether to itemize deductions or take the standard deduction is a significant choice for business owners. It requires careful consideration of various factors, including deductible expenses, documentation requirements, time constraints, potential tax savings, and changes in tax laws. By evaluating these factors thoughtfully and seeking professional guidance when necessary, business owners can make informed decisions that optimize their tax outcomes and financial well-being. |

GLM's BlogIn true blog fashion, the last parts are at the top of the page. Scroll all the way down and work your way back up to read them in order.

Tom GoscheTom is the Business Development Manager for GLM. If you are interested in learning more about GLM's services, contact him: 630-675-8971

[email protected] Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed